Mission Lane Credit Builder Credit Card Review

Feb 21, 2024 By Triston Martin

Are you looking to build good credit but need help figuring out how to get started? Look no further! The Mission Lane Credit Builder Credit Card is designed for people looking to establish or rebuild their credit.

This card is a great option for those with bad, limited, or nonexistent credit history who need an effective and easy way to build a better financial future. In this post, we'll take an in-depth look at the features of this card so you can decide if it's the right fit for your budgeting needs.

Introducing the Mission Lane Credit Builder Credit Card

For people with little or no credit history or those looking to inaugurate credit, the Mission Lane Credit Builder Credit Card is a fantastic choice. The card provides a simple interface and the opportunity to carefully and safely develop your credit. This card has a low interest rate, no annual fee, and may be used without breaking the bank.

The main features of the Mission Lane Credit Builder Credit Card include no annual fee, access to credit reports and scores from all three major bureaus (Experian, Equifax, TransUnion), and a low APR. It also offers cash-back rewards for purchases made with the card.

The card is designed to help you learn how to use your credit wisely while building your credit score. You'll gain access to free tools and tips that can help you pay off debt, manage your budget, and build your credit with responsible card use.

Benefits of Using the Card and How it Can Help Build Credit

The Mission Lane Credit Builder Card has a few key benefits, making it an ideal choice for building credit. First, the card offers a significantly lower APR than most cards for those with bad or limited credit. This makes it easier to pay off the balance without additional interest costs.

The card comes with no annual fee, making it even more cost-effective. Mission Lane also offers a free credit score monitoring feature with the card, so you can track your progress over time and be sure you're taking the right steps to improve your financial standing.

Finally, this card reports to all three major credit bureaus: Experian, Equifax, and TransUnion. Using the card responsibly and paying off your timely purchases will help you build credit quickly.

Security Features and Fraud Protection Details

The Mission Lane Credit Builder Credit Card provides account holders with the security measures and fraud protection they need for peace of mind.

The card has a 128-bit encryption protocol for added security and round-the-clock monitoring through Visa's Zero Liability policy to ensure no one can use your card without authorization.

Furthermore, Mission Lane will contact the account holder with an email or text notification if any suspicious activity is detected.

Mission Lane also offers free Credit Lock services for added protection against identity theft and fraud. When enabled, this feature ensures that credit bureaus can only access your credit information when you explicitly authorize it. As such, only one else can open accounts in your name with your permission.

Pros & Cons of Using the Card

The Mission Lane Credit Builder Credit Card offers some great advantages but also a few drawbacks.

Pros

- It is designed for those with limited or no credit history and can help you establish a positive payment history.

- The Credit Builder card does not require an upfront security deposit, which makes it more accessible than other secured cards.

- Additionally, the card features low-interest rates and fees.

- Mission Lane also offers 24/7 customer service support to help you with questions or concerns.

Cons

- The Credit Builder card is only available in certain states, so not everyone will be eligible to apply.

- Additionally, the card offers no rewards or cash-back programs.

- It also has a relatively low credit limit of $500, which may limit your spending power.

Ultimately, the Mission Lane Credit Builder Credit Card is a great option for those looking to build or repair their credit.

While it may not offer the same rewards and flexibility as other cards, it is an effective way to establish your credit history.

With responsible card use and payment habits, you can improve your credit score and eventually upgrade to a more robust card.

Eligibility Requirements for Applying

A few eligibility requirements must be met for applicants interested in the Mission Lane Credit Builder Credit Card. Applicants must have a valid U.S. Social Security number and be 18 years old.

Additionally, applicants must have an income of at least $1,000 per month before taxes and a U.S. bank account in good standing for at least 90 days before application. Lastly, applicants cannot have active bankruptcies or delinquencies on their credit reports.

Breakdown of Fees and Interest Rates

The Mission Lane Credit Builder card comes with no annual fee, making it a great choice for those who want to avoid paying an ongoing fee each year.

Its interest rate is variable and based on the applicant's creditworthiness, starting as low as 17.99%. It also has a late payment fee of up to $39 and cash advance fees of 3% or $10, whichever is greater.

The Mission Lane Credit Builder card costs less than other credit cards while providing competitive rates and features. It can be a great option for those looking to rebuild their credit with responsible use over time.

FAQs

Is Mission Lane credit Builder good?

Mission Lane Credit Builder is a good option for people with fair or poor credit who want to build their credit score. It reports to all three major credit bureaus, which can help improve your score over time. Additionally, it offers a rewards program that allows you to earn cash back on everyday purchases. Furthermore, there are no annual fees, and the APR is fairly low.

Does Mission Lane credit card help build credit?

Yes, the Mission Lane Credit Builder credit card helps build your credit score. It reports to all three major credit bureaus, which can help improve your score over time. Additionally, it has a low APR and no annual fees, making it an affordable option for those looking to build their credit without breaking the bank.

Is Mission Lane an actual credit card?

Yes, Mission Lane is a legitimate credit card backed by Synchrony Bank. It offers the same features as other traditional credit cards, including rewards points and access to cash advances. Additionally, it is accepted by millions of merchants worldwide.

Conclusion

I hope this Mission Lane Credit Builder Credit Card review has helped you understand what this credit card offers. The credit card is designed to help individuals with no or limited credit history build, improve, and establish their credit.

It also provides a way for them to track their progress. With no annual fee, low-interest rates, and a generous rewards program, this card is ideal for those just starting to build their credit.

-

Know-how May 20, 2024

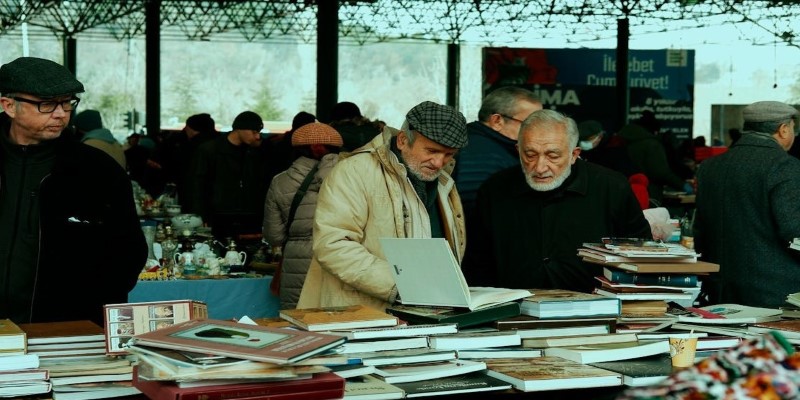

Know-how May 20, 2024Get the Most Cash for Your Used Books: A Comprehensive Guide

Learn how to sell used books online and in person effectively to get the most money for your old reads. Find tips and tricks for maximizing profits in this comprehensive guide.

-

Know-how Feb 24, 2024

Know-how Feb 24, 2024How Do Student Loans Work?

Confused about student loans? We explain how they work, what to expect when borrowing money for school, and all the key factors you must consider before signing that loan agreement.

-

Currency Oct 21, 2024

Currency Oct 21, 2024Forex Made Simple: How to Harness the Power of a Currency Strength Meter

How to use a currency strength meter to improve your Forex trading. Discover the tool’s benefits, how it works, and practical tips for incorporating it into your strategy

-

Banking May 18, 2024

Banking May 18, 2024Uncovering the Best Alternatives to Edgewonk: Elevate Your Trading Game

Discover the best alternatives to Edgewonk, the popular trading journal software. Explore these options by reading this guide to improve your trading performance and get better outcomes.