Naked Puts for Beginners: How This Income Strategy Works in Options

Nov 18, 2024 By Georgia Vincent

Options trading may offer numerous strategies, but among them are the naked put or uncovered short put, which stands apart with its possible income and a risk mix. Here a naked put is selling a put option without holding the underlying stock, which can on one hand generate income by premiums or acquire shares at a lower price if exercised.

However, such a strategy risks a full loss on the initial amount of the price of the stock because it deploys active trading strategies that place the trader at high risk. In this article, we have disassembled naked puts into simple details and then presented them to you in the mechanics and rewards or pitfalls of such a strategy.

What is a Naked Put?

It's called a naked put or uncovered short put. Such an options strategy is undertaken by a trader who sells naked put options without possessing any of the underlying stocks. When a trader sells a naked put, he has agreed to buy shares of a particular stock at a specific price strike price- on or before a particular expiration date. The term naked depicts that the trader has no stock or position held that would fulfill the commitment. Thus, a huge risk is posed if the decline in the price of stock is significant. Although the seller also receives the premium through a sale, this strategy is high-risk.

How Does a Naked Put Work?

Naked puts can generate income, especially in stable or bullish markets where the underlying stock is unlikely to decline significantly. In such cases, the option may expire worthless, allowing the seller to keep the premium without any obligation to buy the stock. This strategy is appealing when targeting stocks that the seller believes are undervalued or will remain stable, providing a steady income stream.

However, the strategy carries substantial risks. If the stock price falls below the strike price at expiration, the seller must buy at that price, potentially resulting in considerable losses if the stock's value declines sharply, as it could theoretically reach zero. Therefore, naked puts are considered one of the riskiest strategies in options trading and are best suited for experienced traders who can manage significant exposure or have sufficient funds to purchase the stock, even at a loss.

Advantages and Disadvantages of Naked Puts

Below, we decompose the main advantages and disadvantages of naked puts so we can more clearly articulate whether or not this strategy fits an investor's goals and tolerance for risk.

Advantages of Naked Puts

Opportunity to Acquire Stocks at Lower Prices: Naked puts allow investors to buy stocks at a discount if the price falls below the strike price. The premium received from selling the option effectively reduces the purchase cost. This can be a strategic way to acquire stocks believed to be undervalued.

Flexibility in Market Strategy: This strategy offers flexibility, enabling traders to earn income from stocks without owning them in advance. Naked puts can be used in various market conditions, including stable or rising markets. They can also complement other trading strategies, allowing for more dynamic portfolio management.

Potential for Leveraged Returns: Naked puts can provide leveraged returns on investment capital, as they often require less capital than buying shares outright. This efficiency allows traders to amplify potential gains if the options expire worthless. Consequently, it enhances the overall return on investment compared to more traditional stock purchases.

Learning Experience for New Traders: Engaging in naked puts can serve as a valuable learning opportunity for less experienced traders. It helps them understand market dynamics, option pricing, and effective risk management. Gaining this knowledge can improve their decision-making skills in future trading endeavors.

Disadvantages of Naked Puts

Open-Ended Downside Risk: In the event that the stock's price drops drastically, the seller is exposed to humongous potential losses because he has to buy the shares at the strike price.

Tremendous Capital Requirement for Margin: Naked puts often use margin accounts and tie up capital because brokers need to have cash available to cover potential losses from obligations.

Lifestyle Constraints: The maximum profit is the premium amount, which is much lower than the enormous risks in volatile market conditions.

Real-Life Example

This is a naked put: an option trader sells a naked put on a stock trading at $100 with a strike of $95 and three months to expiration for a premium of $3 per share, which will be income if the option is exercised. If the stock price is above $95 at the date of expiry, then that option expires worthless and the trader collects the premium worth $3 as his profit.

However, if the stock price falls to $90, then a trader has to buy that stock at the strike price of $95, but it now sells below the market price. They end up paying $92 per share ($95 less the $3 premium), thus losing $2 per share on their stock purchase. This makes naked puts a strategy that can generate income but where losses are huge if the price of the stock falls drastically.

Conclusion

Naked puts is a complex option strategy that can generate potential income but carries huge risks. Best for experienced investors, naked puts require an understanding of market movements and risk reductions. The premium that one gets from selling a naked put is earned money but at the risk of falling stock prices that may drop lower than the strike price forcing the trader to purchase shares at an increased price. It requires a lot of research coupled with extensive knowledge of financial power. Naked puts can add income to a portfolio or allow traders to buy stocks at below-market prices when managed well.

-

Know-how May 20, 2024

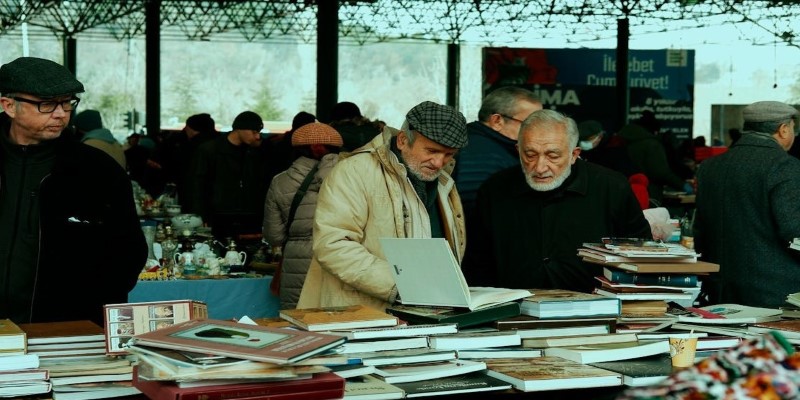

Know-how May 20, 2024Get the Most Cash for Your Used Books: A Comprehensive Guide

Learn how to sell used books online and in person effectively to get the most money for your old reads. Find tips and tricks for maximizing profits in this comprehensive guide.

-

Banking Jan 29, 2024

Banking Jan 29, 2024Chime Credit Builder Credit Card Review

Get the most out of your finances with the Chime Credit Builder Card! In this comprehensive review, learn how it can help you establish or rebuild your credit rating quickly and easily while keeping high-interest rates at bay.

-

Investment May 19, 2024

Investment May 19, 2024A Detailed 2024 Review of the Oxford Club

The Oxford Country Club provides diverse investment strategies and monthly advice, but subscription costs are high.

-

Know-how Sep 18, 2024

Know-how Sep 18, 2024Moneydance Review: Unpacking Its Key Benefits and Features

Discover how Moneydance simplifies personal finance management with its user-friendly interface, comprehensive features, and strong security options.