The Importance of Price Action in Trading: What You Need to Know

May 18, 2024 By Triston Martin

If you're stepping into the realm of trading, you've probably heard about "price action." It's one of those terms thrown around a lot, often with an air of mystique. But fear not; we're here to demystify it for you. In this guide, we'll break down what price action really means, how it influences trading decisions, and why understanding it can make you a more informed trader.

What is Price Action?

Let's delve a bit deeper into the concept of price action. Imagine you're watching a time-lapse video of a bustling city skyline. Each movement, whether it's the rise of a skyscraper or the ebb and flow of traffic, tells a story.

Similarly, in trading, price action is the narrative of a financial asset's journey over time. It includes all of the price chart's oscillations, peaks, and valleys, which represent the dynamic interactions between buyers and sellers.

How Does Price Action Work?

Price action works on the principle that history tends to repeat itself. By analyzing past price movements, traders attempt to predict future price direction. This analysis involves identifying patterns, trends, support and resistance levels, and other crucial factors that can help anticipate market movements.

Patterns in Price Action

Patterns are the building blocks of price action analysis, serving as signposts that guide traders in their decision-making process. Let's explore some common patterns and their significance:

Trendlines

These diagonal lines are drawn to connect consecutive highs or lows on a price chart, providing visual cues about the direction and strength of a trend. Traders often use trendlines to identify potential entry and exit points, as well as to gauge the momentum of price movements.

Head and Shoulders

Three peaks make up this traditional reversal pattern: the head, which is the highest peak, is flanked by two lesser peaks, which are called the shoulders. Being a reliable signal of a trend reversal, it typically indicates a shift in market sentiment from bullish to bearish (or vice versa).

Double Tops and Bottoms

These patterns occur when the price reaches a high (or low) two times with a moderate decline (or rise) in between. They suggest a level of price resistance (or support) that the market struggles to overcome, potentially signaling a reversal in the prevailing trend.

Pin Bars

Also known as hammer or shooting star candles, pin bars feature a long wick or "tail" and a small body. These candlestick patterns often occur at key support or resistance levels and indicate potential reversals in price direction.

Why Price Action Matters

Price movement is a tool for technical research, but it's also a window through which traders may see human psychology and market dynamics more deeply. Here's why it holds such significance:

Simplicity

Unlike complex indicators or algorithms, price action analysis relies on straightforward observations of price movements, making it accessible to traders of all levels of experience. It cuts through the noise and provides a clear, unfiltered view of market sentiment.

Accuracy

Price action analysis focuses on real-time market data, allowing traders to react swiftly to changing market conditions. By studying raw price movements, traders can glean valuable insights into market sentiment and potential price trajectories.

Versatility

Price action techniques can be applied to any market whether it's stocks, forex, or commodities and any timeframe, from intraday scalping to long-term investing. This versatility allows traders to adapt their strategies to different market environments and trading preferences.

Risk Management

By understanding price action and identifying key support and resistance levels, traders can implement effective risk management strategies. This includes setting appropriate stop-loss orders, defining risk-reward ratios, and managing position sizes to minimize potential losses.

Developing a Price Action Trading Strategy

Now that you grasp the essence of price action let's explore how you can integrate it into a robust trading strategy:

Educate Yourself

Examine a variety of patterns, chart formations, and technical analysis ideas to gain a thorough understanding of price activity. To aid with your knowledge expansion, there are innumerable resources available, ranging from books and online courses to webinars and trade forums.

Practice Patience and Discipline

Trading price action demands self-control and patience. Refrain from following every move in the price and instead look for high-probability setups that fit your trading strategy. Recall that missing a trade is preferable to entering hastily and suffering needless losses.

Combine with Other Tools

Although price action is a powerful tool by itself, it can be even more effective when combined with other technical indications and tools. Try out moving averages, volume analysis, Fibonacci retracements, and other supplementary tools to confirm your price action signals and optimize your entry and exit points.

Back Test and Refine Your Strategy

Before risking real capital, back test your price action strategy on historical data to evaluate its performance under various market conditions. This process will help you identify strengths and weaknesses, optimize your trading parameters, and build confidence in your approach.

Prioritize Risk Management

In your trading attempts, risk management should come first. This entails diversifying your portfolio to spread risk across several assets, establishing suitable stop-loss orders to limit potential losses, and following good money management practices to protect capital over time.

Conclusion

Price action is more than simply a trading method; it's a way of thinking that enables traders to confidently and clearly negotiate the intricacies of the financial markets. Traders may understand the language of the market, predict future price changes, and make well-informed trading decisions by becoming proficient in price action research.

Recall that successful trading is about accepting uncertainty, skillfully managing risk, and remaining flexible in the face of shifting market conditions rather than chasing illusive profits or anticipating every move the market will make. Thus, equip yourself with knowledge, polish your abilities, and may price action's wisdom direct your trading career.

-

Investment May 19, 2024

Investment May 19, 2024A Detailed 2024 Review of the Oxford Club

The Oxford Country Club provides diverse investment strategies and monthly advice, but subscription costs are high.

-

Banking May 18, 2024

Banking May 18, 2024Uncovering the Best Alternatives to Edgewonk: Elevate Your Trading Game

Discover the best alternatives to Edgewonk, the popular trading journal software. Explore these options by reading this guide to improve your trading performance and get better outcomes.

-

Know-how May 20, 2024

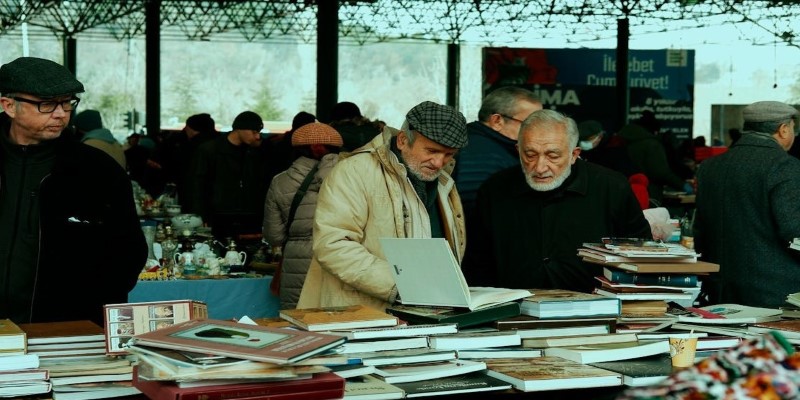

Know-how May 20, 2024Get the Most Cash for Your Used Books: A Comprehensive Guide

Learn how to sell used books online and in person effectively to get the most money for your old reads. Find tips and tricks for maximizing profits in this comprehensive guide.

-

Business Oct 24, 2024

Business Oct 24, 2024Prepare for a Business Loan Meeting: Tips for Success

This article provides a detailed guide on how to confidently approach your lender for a business loan. Learn how to prepare, what documents to bring, and how to present your business plan to increase your chances of securing the loan. Tips include organizing your financials, improving your personal credit, and offering collateral to back your request.