Finding the Currency Basket: A Simple Guide to Its Role and Relevance in Global Finance

Nov 30, 2024 By Elva Flynn

In a global economy where exchange rates affect all aspects of international trade and investment, the idea of a currency basket has become an essential tool for policymakers, corporations, and investors. In this post, I'll explain this concept, explain how it works, why it's important, and use real-world examples to show its value.

What Is a Currency Basket?

Basically, a currency basket is a grouping of different national currencies in a particular proportion. The value of any other currency is measured by how much money will buy one of these baskets. Pegging a currency to a single foreign currency gives you less flexibility, but you can peg to a basket of more or less the same, and you're less susceptible to market shocks.

The utility of a currency basket comes down to one core purpose: managing the value of a currency. Currency risk is diversified when countries or institutions choose more than one currency. This structure means that fluctuations in one currency will not directly translate into the other currency, which makes for a more stable international transaction.

How Does a Currency Basket Work?

The operation of a currency basket hinges on three main steps: currency selection, weight assignment, and composite index calculation.

Selection of Currencies

Economic and trade relations, as well as currency's importance on the global economy, determine which currencies are included in the basket. The U.S. Dollar Index is an example by example; this is the index that measures the strength of the U.S. dollar and consists of the major world currencies such as the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. The basket is a well-rounded measure of the dollar's value as each currency selected reflects the currency's role in global trade and finance.

Assignment of Weights

After selecting the currencies, each one is assigned a specific weight based on its significance. The weighting system might take into account factors like trade volume with the issuing country, economic stability, or the liquidity of its financial markets. For instance, in the U.S. Dollar Index, the euro carries the highest weightaround 57.6%due to the substantial trade relationship between the United States and the Eurozone.

Calculation of the Composite Value

Once weighted, the individual values of the baskets currencies are combined to produce a composite value or index. This index acts as a benchmark against which the value of another currency is compared. For example, countries or institutions might measure their currencys strength against the SDR (Special Drawing Rights), a currency basket managed by the International Monetary Fund.

The Significance of Currency Baskets in Global Finance

Currency baskets hold significant value in international finance for several reasons:

Stabilizing Exchange Rates

Currency baskets help governments and institutions stabilize exchange rates by reducing the dependence on a single foreign currency. For instance, if a country pegs its currency to a single currency like the U.S. dollar, it becomes highly vulnerable to fluctuations in that currency. A currency basket, on the other hand, mitigates this risk by spreading the potential impact across multiple currencies.

Risk Diversification

Currency baskets also allow countries and companies to diversify risk. When businesses have exposure to multiple currencies, a currency basket provides a more balanced way to manage that exposure, ensuring that fluctuations in one currency wont drastically affect overall value. This approach is especially valuable for investors and corporations involved in multinational trade.

Benchmarking and Policy Evaluation

For central banks and policymakers, currency baskets serve as benchmarks to assess the effectiveness of monetary policy. Tracking how their currency performs against a basket rather than a single currency provides a clearer view of its stability, enabling more informed adjustments to economic policy.

Examples of Currency Baskets in Practice

To better understand how currency baskets work, lets look at some practical examples:

Special Drawing Rights (SDR)

Managed by the International Monetary Fund (IMF), the SDR is a prominent example of a currency basket used on an international scale. This reserve asset includes the U.S. dollar, euro, Chinese yuan, Japanese yen, and British pound. Countries can use SDRs as a form of liquidity in times of economic crisis. The SDR also serves as a unit of account for the IMF, making it a valuable tool for international settlements.

U.S. Dollar Index (DXY)

The U.S. Dollar Index is a currency basket that measures the dollar's value relative to a group of major global currencies. This index offers insight into the dollar's strength on the international stage and is widely followed by forex traders. Fluctuations in the DXY provide indications of the U.S. economy's health, influencing everything from interest rates to investment decisions.

European Currency Unit (ECU)

Before the introduction of the euro, the ECU served as a currency basket within the European Union. Comprised of a combination of European currencies, the ECU was used as a unit of account for transactions among EU member states, facilitating greater stability and paving the way for the creation of the euro. This basket structure fostered cooperation among countries, allowing them to maintain exchange rate stability before adopting a unified currency.

Asian Monetary Unit (AMU)

Proposed as a currency basket for Asian economies, the AMU seeks to provide stability in a region marked by diverse currencies and economic policies. Although yet to be adopted, the AMU would include key currencies from the area, such as the Japanese yen, Chinese yuan, and South Korean won. The goal of this basket is to foster stronger regional integration, reducing reliance on external currencies like the dollar.

Conclusion

In todays interconnected global economy, currency baskets offer an innovative solution to currency volatility and economic instability. By spreading exposure across multiple currencies, these baskets provide a more stable and balanced reference point, essential for countries, investors, and institutions involved in global finance.

-

Mortgages Feb 19, 2024

Mortgages Feb 19, 2024FHA loan credit score requirements: FHA for low-credit buyers

Find out how an FHA loan could be the ideal solution for low-credit buyers to buy a home! We provide details on the credit score requirements, the advantages of this lending option, and other useful tips.

-

Investment Nov 07, 2023

Investment Nov 07, 2023Are You Eligible for Life Insurance?

Take a few moments to understand the ins and outs of life insurance with this comprehensive guide. We'll cover eligibility criteria, benefits, and more — get all the facts before making decisions!

-

Know-how May 20, 2024

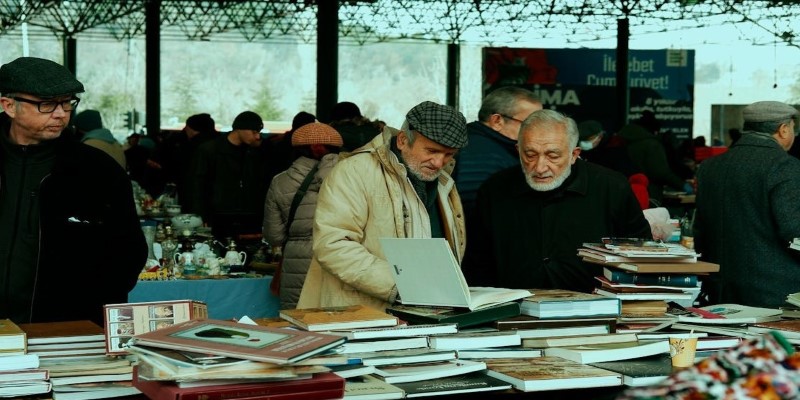

Know-how May 20, 2024Get the Most Cash for Your Used Books: A Comprehensive Guide

Learn how to sell used books online and in person effectively to get the most money for your old reads. Find tips and tricks for maximizing profits in this comprehensive guide.

-

Banking May 18, 2024

Banking May 18, 2024Uncovering the Best Alternatives to Edgewonk: Elevate Your Trading Game

Discover the best alternatives to Edgewonk, the popular trading journal software. Explore these options by reading this guide to improve your trading performance and get better outcomes.