How Construction Loans Work: Your Ultimate Guide to Financing a New Build

Oct 26, 2024 By Darnell Malan

In the world of real estate, construction loans play a pivotal role, especially for those looking to build their dream homes from the ground up. Unlike traditional mortgages, which are designed for purchasing existing properties, construction loans are tailored specifically for funding the building process.

Whether you're an experienced builder or a first-time homeowner, understanding construction loans can empower you to make informed financial decisions and successfully navigate the construction journey. In this article, well break down what construction loans are, how they work, the various types available, and the steps involved in securing one.

What Are Construction Loans?

Construction loans are short-term financing options used to fund the building of new homes or major renovations. Unlike traditional mortgages, which provide a lump sum, construction loans are disbursed in stages or "draws" as the project reaches key milestones, such as completing the foundation or roofing.

These loans typically cover costs like materials, labor, permits, and some soft costs like architectural fees, but they generally exclude land unless purchased with the loan. Due to the higher risk for lenders, construction loans usually have higher interest rates and stricter qualification requirements than conventional mortgages.

Types of Construction Loans

Several types of construction loans cater to different needs and scenarios. Understanding these options can help you choose the right one for your project.

Construction-to-Permanent Loans

Also known as a "one-time close" loan, this type of financing combines a construction loan and a permanent mortgage into one loan. During the construction phase, borrowers only pay interest on the amount drawn, and once the project is complete, the loan converts into a traditional mortgage. This option simplifies the financing process and eliminates the need for two separate closings.

Standalone Construction Loans

These loans cover only the construction phase. Borrowers typically pay interest during construction and then need to secure a separate mortgage to pay off the construction loan once the home is completed. While this option may offer flexibility in terms of financing, it can involve higher closing costs and interest rates.

Renovation Loans

For those looking to renovate an existing property rather than build from scratch, renovation loans can be an excellent option. These loans provide funds specifically for home improvement projects, allowing homeowners to tap into the equity of their current property or secure financing based on the expected increase in value after renovations.

Owner-Builder Loans

If you're planning to act as your general contractor, an owner-builder loan may be the best fit. This type of financing allows individuals to manage their construction projects. However, these loans often come with stricter requirements, as lenders need to ensure that the borrower has the experience and skills to complete the project.

Federal Housing Administration (FHA) Construction Loans

FHA construction loans are designed for borrowers who may not qualify for conventional financing. These loans require a lower down payment and are backed by the federal government, making them more accessible to first-time homebuyers or those with less-than-perfect credit.

The Construction Loan Process

Understanding the construction loan process is crucial for anyone looking to enfold on a building project. It begins with selecting a lender that offers construction loans. Not all financial institutions provide this type of financing, so it's essential to research and compare options to find one that meets your needs. Once you've identified a lender, the next step is to prepare a detailed project plan, including a budget, timeline, and construction schedule. This plan will be critical in demonstrating to the lender that your project is viable and well thought out.

After submitting your application, the lender will conduct a thorough review, assessing your creditworthiness, the project's feasibility, and the builder's qualifications if you're working with one. They will also require an appraisal of the property's potential value upon completion. This appraisal helps the lender determine how much they are willing to finance based on the expected value of the completed home.

Once your loan is approved, the construction loan agreement will outline the terms, including the interest rate, repayment schedule, and draw schedule. It's important to carefully review these terms to ensure they align with your financial capabilities and project timeline.

Potential Risks and Considerations

While construction loans can be a great tool for financing your dream home, they also come with certain risks and considerations. Understanding these factors can help you make a more informed decision.

Cost Overruns

Construction projects often encounter unexpected costs, whether due to material price fluctuations, labor issues, or design changes. It's essential to budget for these potential overruns and have a contingency plan in place. Lenders may also require a reserve for such situations, which can add to your overall financing needs.

Project Delays

Delays are a common issue in construction, whether due to weather conditions, labor shortages, or permit delays. These setbacks can impact your budget and may lead to higher interest payments if the project takes longer than expected.

Interest Rates

Construction loans generally have higher interest rates than traditional mortgages, reflecting the increased risk for lenders. Be sure to compare rates from multiple lenders and understand how these rates may affect your overall budget.

Builder Risks

If you're working with a contractor, their reliability and experience play a significant role in the project's success. Do thorough research and consider getting recommendations or reading reviews to ensure you're hiring someone who will deliver quality work on time and within budget.

Conclusion

In conclusion, construction loans are a vital financing option for anyone looking to build or significantly renovate a home. Understanding how these loans work, the types available, and the qualification process can empower you to make informed decisions as you start on your construction journey.

While construction loans may come with risks and challenges, they also offer the opportunity to create a home tailored to your needs and preferences. By approaching the process with a solid plan, careful budgeting, and diligent research, you can navigate the world of construction loans and turn your vision into reality.

-

Know-how May 20, 2024

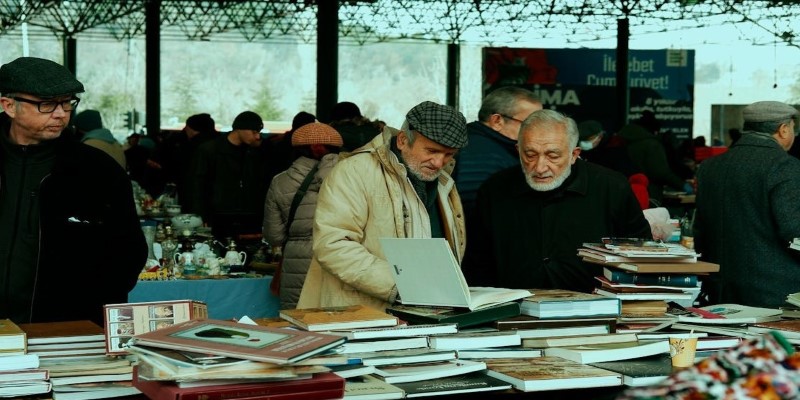

Know-how May 20, 2024Get the Most Cash for Your Used Books: A Comprehensive Guide

Learn how to sell used books online and in person effectively to get the most money for your old reads. Find tips and tricks for maximizing profits in this comprehensive guide.

-

Banking Oct 26, 2024

Banking Oct 26, 2024How Construction Loans Work: Your Ultimate Guide to Financing a New Build

Our in-depth guide covers everything about construction loans—from types and qualifications to the loan process—so you can confidently finance your home construction project

-

Investment Nov 07, 2023

Investment Nov 07, 2023Are You Eligible for Life Insurance?

Take a few moments to understand the ins and outs of life insurance with this comprehensive guide. We'll cover eligibility criteria, benefits, and more — get all the facts before making decisions!

-

Mortgages Feb 19, 2024

Mortgages Feb 19, 2024FHA loan credit score requirements: FHA for low-credit buyers

Find out how an FHA loan could be the ideal solution for low-credit buyers to buy a home! We provide details on the credit score requirements, the advantages of this lending option, and other useful tips.